INSIGHTS

IS CRYPTOCURRENCY GOING MAINSTREAM?

Olivia Sandlant, 20 May 2021

What is cryptocurrency?

A cryptocurrency is a digital currency that takes the form of tokens or ‘coins’ and works using blockchain - a decentralised technology spread across various computers that manages and records transactions.

Everyone seems to know someone who has taken a punt on some type of cryptocurrency and made a windfall profit, but what is crypto? And is it going mainstream?

Cryptocurrency has been front of mind for a lot of people of late. Trading platform Coinbase listed on the Nasdaq stock exchange recently, in somewhat of a landmark for the industry.

Its valuation reached more than US$80 billion after its first day of trading – that’s more than five times the size of Fisher & Paykel Healthcare, New Zealand’s largest listed company. Coinbase was originally founded to facilitate the purchase and trading of Bitcoin alone, but it now has more than 50 different cryptocurrencies on its platform.

When most people think of cryptocurrency they immediately think of Bitcoin, and while it may have been the trendsetter, there are now more than 10,000 different types of cryptocurrency.

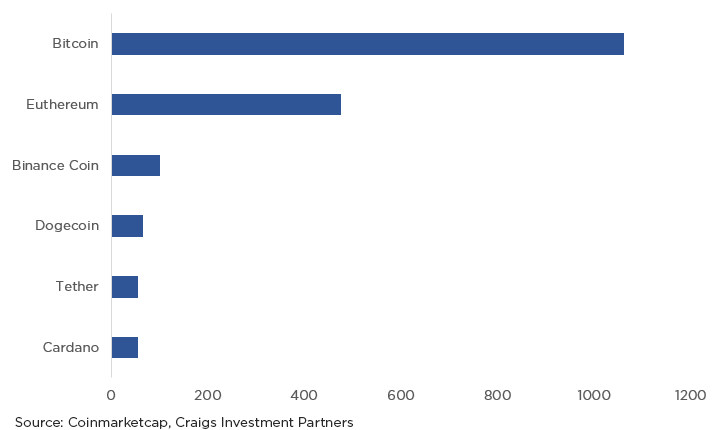

Bitcoin is still the largest and most well-known, and it accounts for more than half of the US$2 trillion cryptocurrency market. Ethereum is second, with a total market value of about US$400 billion, while Binance Coin comes in third with a value of about US$100 billion.

Dogecoin - which was initially invented as a joke – recently hit a total market value of over US$75 billion.

Market value of the largest cryptocurrencies

Some of the advantages crypto offers when used as a medium of exchange are anonymity, low transaction fees and security of payments. However, it is debatable whether it can yet be considered as money. Many buyers are buying cryptocurrencies in the hope they rise in value, rather than because it can be easily or widely used to buy goods or services.

Some companies have adopted cryptocurrencies and blockchain

An increasing number of large companies have adopted blockchain technology or begun to facilitate the trading of cryptocurrencies. Some may anticipate cryptocurrencies going further mainstream, while others could just be hedging their bets.

The Australian Stock Exchange will be the first stock exchange globally to implement blockchain, after two years of development. The technology will allow for faster, cheaper and more secure transactions. It is hoped this will save money for traders, make the ASX more competitive globally, and increase trade traffic.

Other companies have also started offering cryptocurrency as a payment option for transactions. This includes Paypal which now offers customers in the US the option to buy, sell, hold, and pay at the checkout with four different cryptocurrencies.

Cryptocurrency exchange traded funds (ETFs) are also on the rise. Many firms have applied to the US Securities and Exchange Commission for approval to create Bitcoin ETFs.

These are funds that would track the value of Bitcoin and trade on traditional sharemarket exchanges, rather than cryptocurrency exchanges. They would allow investors to invest in Bitcoin (or other cryptocurrencies) more easily, without using a specialist cryptocurrency exchange.

Cryptocurrencies have a few major obstacles to overcome

The rise of cryptocurrency has been remarkable. However, the digital asset still faces many issues and poses risks which investors should be aware.

One of the main issues is that cryptocurrency and the exchanges that trade it are largely unregulated. This can make them more susceptible to hacks or other criminal activity, such as fraud and manipulation.

A number of security breaches have led to sizable losses for investors who have had their digital currencies stolen. Coupled with the often criminal use of Bitcoin and the desire of governments to control the money supply, this could elicit a tougher regulatory response in the future.

Cryptocurrencies don’t provide any income stream, which means the only way an investor can get a return is rising prices and others being willing to pay more in the future. Cryptocurrency prices are highly susceptible to volatile price movements – even from something as simple as a tweet by the likes of Tesla founder Elon Musk.

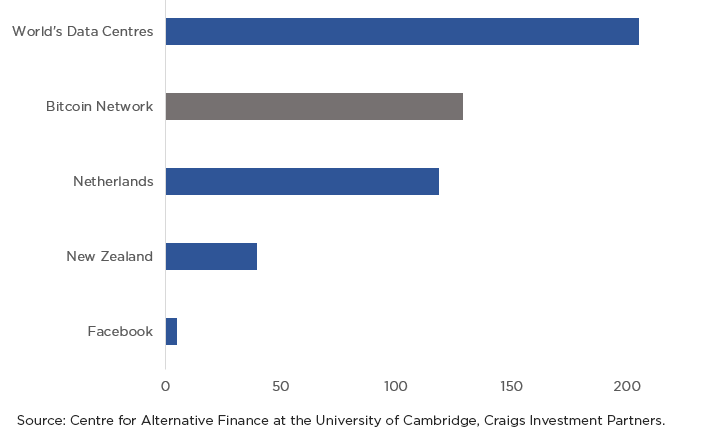

Cryptocurrencies are also tremendously unfriendly to the environment. New Bitcoins must be ‘mined’ by solving difficult mathematical problems requiring vast sums of electricity.

The Centre for Alternative Finance at the University of Cambridge estimates that Bitcoin mining and transaction processing uses more electricity in a year than the entire nation of the Netherlands, and three times that of New Zealand.

This is hard to justify at a time when all countries and companies are striving to lower their emissions footprints.

Bitcoin uses as much power as the Netherlands (TWh used)

Be mindful of the risks

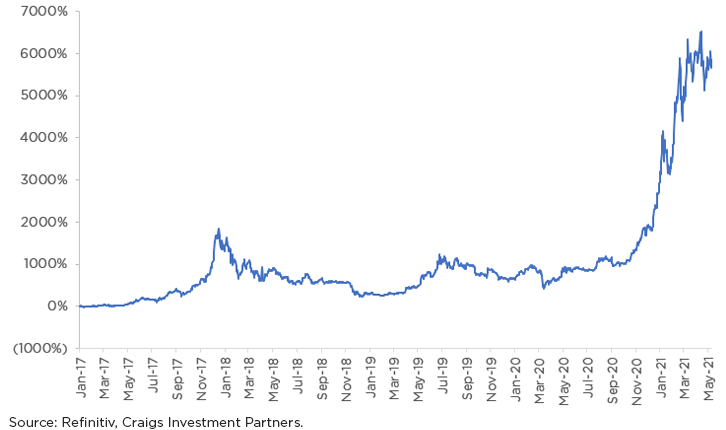

With cryptocurrencies such as Dogecoin soaring 14,000 per cent since the start of the year, the thought of investing into crypto can seem exciting. However, potential investors also need to be wary of the extreme price volatility that can occur.

In 2018, for example, the price of Bitcoin plummeted to just above US$3,000, more than 80 per cent below its previous high of US$20,000, which it had reached in late 2017.

Investors must also be mindful of the lack of regulation or protection against theft, both of which add an additional level of risk and uncertainty.

Total return of Bitcoin over the past 5 years